The Foundation Stones Of A New Business (Part 5) A Business Plan and Cash Flow Forecast

The Foundation Stones Of A New Business (Part 5) A Business Plan and Cash Flow Forecast

It’s exciting when you have that light bulb moment, that flash of brilliance and idea for your new business. It’s hard not to get carried away with the excitement but turning your idea into a business necessitates research, risk, passion and planning. There are very few shortcuts and no amount of enthusiasm, hard work or talent can guarantee your business success.

There are numerous issues you need to address before you can open your doors and having mentored hundreds of business owners through the

start-up phase we often say starting a business is like building a house. You need to have a plan and build on solid foundations. In a

business sense this means having things like the right business structure, branding, accounting software and insurances. You also need a

financial budget and a marketing plan.

There are numerous issues you need to address before you can open your doors and having mentored hundreds of business owners through the

start-up phase we often say starting a business is like building a house. You need to have a plan and build on solid foundations. In a

business sense this means having things like the right business structure, branding, accounting software and insurances. You also need a

financial budget and a marketing plan.

In this series of articles, we are examining the 8 foundation stones for a new business and the focus of this post is the need for a Business Plan and Cash Flow Budget.

The main reason most people prepare a business plan is to raise finance. Typically, a potential lender will want to know all about you and your proposed venture. The business plan provides all this information in a logical and structured format so investors can then evaluate your ‘pitch’ and make an informed investment decision.

Of course, your business plan should be substantially more than just a document to satisfy your investors. It should prove the financial

viability of your business and provide an overview of where you plan to take the business and how you intend to get there. It is the

blueprint for your future business success.

Most business owners fail to make a start on their business plan because they are either too busy or don’t understand what is required in

the plan. Too often they are busy working IN the business dealing with day to day issues instead of working ON the business with strategic

planning. Without a business plan you can’t measure your success or establish your priorities. Your business is effectively a ship without a

rudder.

To succeed you need a clear vision for your business and your plan you should outline where you want to take the business in the medium to long term. It can be expressed as a series of objectives and then detail the strategies, tools and people who are going to make it happen.

Your plan should incorporate your projected financials into the plan but so many business owners fail to put pen to paper because they are waiting for more certainty regarding their sales projections, funding or costs. Remember, your business plan should steer your activity, not the other way around. To help you we can do some financial modelling and produce forecasts based on different scenarios and price points.

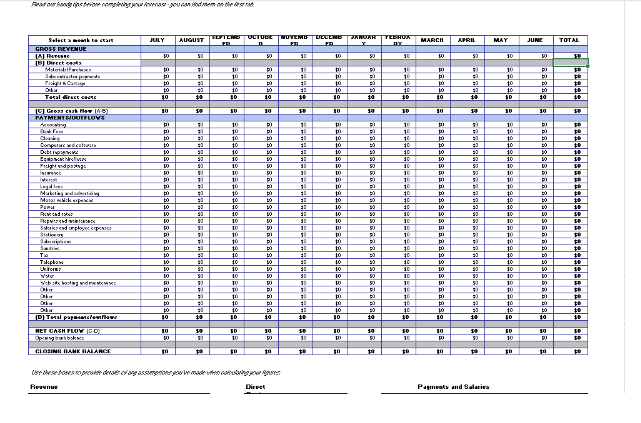

Obviously, a positive cash flow is a necessity if your business is to succeed and positive cash flow just doesn’t happen, it needs to be planned. You need to prepare a 12-month cash flow forecast before you start the business. In fact, any business that fails to accurately forecast its cash flow in the first 12 months is on a collision course. Without realistic cash flow projections, management cannot identify future cash shortages. You need to prepare your cash flow budget based on a number of assumptions regarding the expected future performance of the business. The assumptions must be realistic and be supported by research, available data plus known facts such as rent and forward contracts. The information in your cash flow budget is designed to:

-

forecast your likely cash position at the end of each month

- identify any fluctuations that may lead to potential cash shortages

- plan for your taxation payments

- plan for any major capital expenditure, and

- provide prospective lenders with key financial information

Of course, positive cash flow alone is not enough. The business must be returning a profit and the long-term trend for both must be positive. All too often we hear of profitable small businesses that lack sufficient working capital which spells disaster.

Your cash flow forecast starts with sales projections and this must be based on specific assumptions and factor in things like the seasonality of your business and the state of the economy. From a cash flow point of view, you need to think about how quickly you’ll get paid after invoicing your customers. Ask yourself, if you expect to be paid in 30 days what would happen to your cash flow if that blew out to 90 days? Would you need to borrow more from the bank at that point? Going back to the bank for an extension of your overdraft or sourcing extra loans after just three months of trading would set off alarm bells at the bank.

Once you are comfortable with the cash receipt projections it’s time to consider the expenses. We have produced a ‘Business Start Up Expense Checklist’ that you can download from the Resources section of our website. It dissects your start-up costs into categories like the office or shop fit out, equipment, IT expenses, professional fees, marketing costs and furniture. These figures then slot neatly into our cash flow budget template and produce a forecast of your first year's trading results.

While preparing cash flow projections can be time consuming, the truth is, as the business owner you are the most qualified person to

develop your cash flow forecast. You’ve researched the market, know your costs and your competitor’s prices.

While preparing cash flow projections can be time consuming, the truth is, as the business owner you are the most qualified person to

develop your cash flow forecast. You’ve researched the market, know your costs and your competitor’s prices.

If you are contemplating starting a business, the evaluation and establishment phases can be periods of great anxiety due to a combination of excitement, uncertainty and financial risk. Over the years we have built a reputation as business start-up specialists and have put together a range of tools, templates and checklists to help you get your business off to a flying start. If you're contemplating starting a business talk to us today about our New Business Starter Kit that contains templates for a business plan, cash flow budget, profit and loss forecast together with our unique 82 step start-up checklist.

Stay tuned for the next instalment in this series that examines the importance of legal issues and contracts.

DISCLAIMER

This is general information only. It simply provides an overview of alternative business structures available at the date of publication. It does not serve as advice and no action should be taken on the information provided herein without consulting the relevant legislation or seeking professional advice from your accountant, solicitor or professional advisor. No responsibility for loss occasioned by any person acting on the material contained in this document can be accepted by the accounting firm.